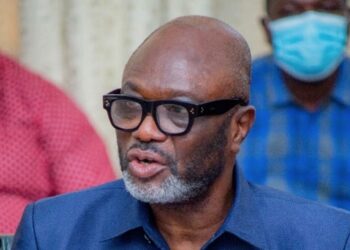

Private legal practitioner Mr Kofi Bentil is taunting persons who saved Dollars in in anticipation that the Cedi will fall further to enable them profit from the sale of their foreign currency.

The local currency has over the past few days, especially since the start of December 2022, been gaining strength against the major trading currencies particularly, the Dollars.

As of Wednesday morning, the Cedi was trading at $1 to GHS10.3948 per the Bank of Ghana Exchange rate.

Commenting on this trend in a Facebook post, Mr Kofi Bentil said “You acted rationally and saved in dollars, which automatically means you wish that the cedi will fall so you profit.

“Well it’s a risk you took and I’m happy the cedi is appreciating. Better for Ghana bad for you.”

The government has recently taken some measures to support the economy especially the currency.

The Finance Minister Ken Ofori-Atta launched the debt exchange programme with the objective to alleviate the debt burden in a most transparent, efficient, and expedited manner.

In this context, by means of an Exchange offer, he said the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds.

“In particular, it does not embed any principal haircut on Eligible Bonds, as we promised. Let me repeat this fact as plainly as I can, in this debt exchange individual holders of domestic bonds are not affected and will not lose the face value of their investments. So let us remove any doubt and discard any speculation that the Government is about to cut your retirement savings or the notional value of your investments.

“That is not the case. As already announced, Treasury Bills are completely exempted, and all holders will be paid the full value of their investments on maturity. There will be NO haircut on the principal of bonds. Individuals who hold bonds will also not be affected at all.

“Our domestic debt operation involves an exchange for new Ghana bonds with a coupon that steps up to 10% as soon as 2025 (with a first interest payment in 2024) and longer average maturity. Existing domestic bonds as of 1st December 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.”

The government of Ghana also announced a move to buy crude oil with gold. This is expected to start next year. This is an attempt by the country to move away from the US dollar for international transactions.

In respect of this arrangement, Governor of the Bank of Ghana, Dr Ernest Addison has said the Precious Minerals Marketing Company (PMMC) would play a key role in the move.

The PMMC, he said, would be buying a lot of the gold from licensed gold exporters who he indicated, have significant amount of gold.

“The PMMC will be providing most of the gold to be used for crude oil swap,” he said during the Monetary Policy Committee (MPC) press conference in Accra on Monday, November 28.

He further said that the major mining companies operating in Ghana were consulted on the move.

Dr Addison said that in the meeting where this idea came up, the major mining companies including Newmont and AngloGold were all present.

They all cooperated with this idea, Dr Addison added.

He said “the major mines were consulted, Newmont and the AngloGold were all part of the meeting that we had together with the Vice President when the decision was taken that they will, from 2023, sell at least 20 per cent of their production of gold to the central bank.

“In fact, most of the mining companies who were at that meeting were very cooperative, it was not something which was forced on them, they were ready to contribute their quota to support Ghana during these difficult times.”

The Vice President Dr Mahamudu Bawumia who announced this move stated that some analysts and commentators misinterpreted Ghana’s stated policy of using gold reserves to pay for oil.

Speaking at the 2022 AGI Awards in Accra, Dr Bawumia noted that to the contrary, Ghana’s gold-for-oil programme will give Ghana the space to accumulate more international reserves as the country will save the $3 billion it spends on oil imports.

He further stated that the use of gold was specifically for oil imports in the face of declining foreign exchange reserves.

Unfortunately, some people have misinterpreted this as Ghana being against the use of the US dollar in international transactions,” he stated.

“Far from it. We want to accumulate more US dollar reserves in the future.”

Vice President Bawumia noted that a major source of Cedi depreciation has been the demand for forex to finance imports of oil products and to address this challenge, government is negotiating a new policy regime where sustainably mined gold will be used to buy oil products.

we implement the gold-for-oil policy as it is envisioned, it will fundamentally change our balance of payments and significantly reduce the persistent depreciation of our currency with its associated increases in fuel, electricity, water, transport and food prices.”

This, he noted, is because the exchange rate will no longer directly enter the formula for the determination of fuel or utility prices since all the domestic sellers of fuel will no longer need foreign exchange to import oil products

SEND A STORY: Do you have a story for us or need a promotion / advertisement? Submit them via our email dannyboy744@gmail.com and via on +233 266777777