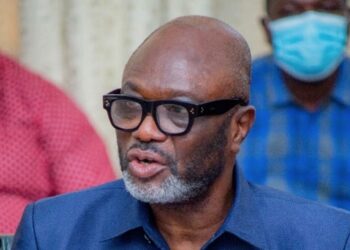

The Financial Statement and Economic Policy for the year ending December, 2023 was presented to Parliament on Thursday by the Finance Minister, Ken Ofori-Atta.

Here are 5 take ways from the 2023 budget.

- Hiring freeze for civil and public servants

The government, as part of measures to reduce expenditure, will not be employing any civil or public servants in 2023.

The Finance Minister Ken Ofori-Atta said the “hiring freeze for civil and public servants” formed part of cabinet directives on expenditure measures in the harsh economic times.

Although the policy was presented as emanating from Cabinet, it is no doubt part of the International Monetary Fund’s (IMF) conditions for enrolling the country unto a programme after the sharp economic slum.

The John Mahama administration succumbed to a similar policy derivative from the Bretton Woods institution when the country enrolled unto a $1billion IMF programme in 2015.

- MoMo transactions will cost more

The controversial E-Levy has been slashed from 1.5% to 1%.

This is not going to ease users’ pain of using electronic payment platforms.

On the contrary, low-income consumers will pay more to use MoMo and other E-payment services as the government seeks to legalise scrapping the GH¢100 daily threshold.

Mr Ofori-Atta said the government seeks to do so with the 2023 budget, but consumers took to social media to decry the government for already implementing the policy.

- Cost of production to increase with increased VAT

The Akufo-Addo administration, in its first term increased Value Added Tax (VAT) through the back door by separating the NHIL and GETFund components.

This increased the cost of doing business and consequently led to price increases.

Now, the base rate of the Value Added Tax would be increased by 2.5% should the budget be approved. This would move the rate from 12.5% to 15%, with many pointing to the hypocrisy of President Akufo-Addo, having been one of the leaders of a demonstration against the VAT, in 1995, as an opposition leader.

- Restriction on V8s critical or cosmetic?

The government is also restricting the use of V8 vehicles by its officials except for cross country trips.

This is also touted as a means of cutting costs.

The effectiveness of this is doubtful. It rather appears populist with the growing public outcry against the use of that luxury vehicle.

Officials are still at will to use other 4WDs which consume fuel as much as the V8 engines do.

- The Politics — massive parliamentary loss a possibility

Essentially, the 2023 budget will do little to ease the burden on taxpayers and majority of the workforce who are at the bottom of the economic food chain.

The politics of it may also sting.

A showdown is expected in Parliament when debate on the policy document begins.

The 2022 budget saw a great battle which saw friction between the Speaker, Alban Bagbin and the First Deputy Speaker, Joe Osei-Owusu who is MP for Bekwai, NPP.

Mr. Osei-Owusu, in Bagbin’s absence, reversed the decision of the Speaker to block the budget, a move which caused controversy in the House for weeks.

If that budget was described by NDC legislators as onerous, the 2023 document will face fiercer actions.

The capriciousness of some 98 NPP Members of Parliament may also cost them more than they bargained for.

The MPs, claiming to stand by the people, asked for the resignation of the Finance Minister for leading the country into crisis but have since changed that position for the second time now.

They promised to boycott the budget reading should Akufo-Addo not yield to their demands to relieve the Minister of his position but they made a U-turn, came back to the original position and then reversed their decision again, succumbing to pressure from the party.

If their constituents decide to vote on issues, they could suffer the fate of the Labour Party in UK where Tories won in hardline Labour constituencies in 2018 after the Labour Party unreasonably halted government action amid Brexit negotiations which caused the snap election.

Conclusion

Briefly, the 2023 budget, if approved, is unlikely to reduce pressure on the ‘average Ghanaian’ unless strong political steps like cutting government size are implemented.

VAT and the burdensome MoMo Tax must also go while the depreciation of the cedi must be halted alongside other interventions such as arresting fuel price hikes.

SEND A STORY: Do you have a story for us or need a promotion / advertisement? Submit them via our email dannyboy744@gmail.com and via on +233 266777777