The Economic and Financial Crime Division of the High Court in Accra has granted bail in the sum of GH¢ 200 million with three sureties to the founder and former Chief Executive Officer of defunct Beige Bank Limited.

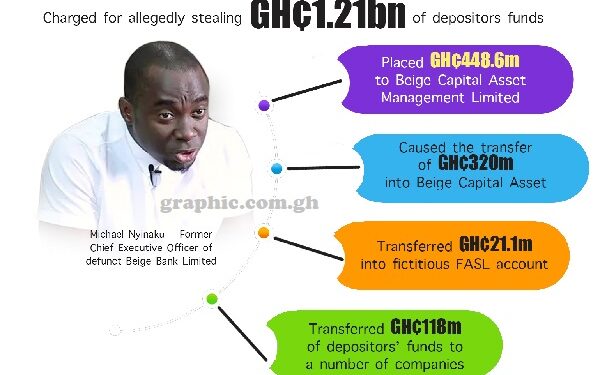

Michael Nyinaku has been charged at the court, presided over by Justice Afia Serwah Asare-Botwe, for allegedly stealing GH¢1.21 billion of depositors’ money from the bank.

He pleaded not guilty to 43 charges of stealing, fraudulent breach of trust and money laundering when he mounted the dock yesterday.

A Deputy Attorney-General, Alfred Tuah-Yeboah, who represented the state did not oppose the bail application by counsel for Nyinaku, Addo Attuah.

Bail conditions

Out of the three sureties, two must be justified.

The two are to deposit their documents covering landed properties worth the GH¢ 200 million bail bond.

The properties are to be valued by either the Land Valuation Division or the Architecture and Engineering Services Limited.

The accused has also been ordered to report to the case investigator every Monday and Friday at 9 a.m.

He is to deposit his passport at the court registry.

The court also ordered the prosecution to file disclosures by December 9, 2022.

The case has been adjourned to December 22, 2022, for case management conference.

Prosecution’s facts

The facts as narrated by Mr Tuah-Yeboah were that on August 1, 2018, the Bank of Ghana (BoG) revoked the banking licence of Beige Bank and placed it in receivership.

He said a review of the financial and other records of the bank conducted by the Receiver and his team identified a number of suspicious and unusual transactions, which were, subsequently, reported to the law enforcement agencies for investigations.

He further told the court that investigations revealed that between 2015 and 2018, Nyinaku, as CEO of the bank, used various means to transfer huge sums of depositors’ money to companies related to him and for his personal benefit.

“Between 2017 and 2018, the accused person caused the transfer of 10,071 fixed deposit accounts held with Beige Bank in which various customers placed a total of GH¢448.6 million to Beige Capital Asset Management Limited (BCAM), without the knowledge and consent of these customers. BCAM is a limited liability company wholly owned by The Beige Group Limited (Beige Group), an entity which in turn is wholly owned by the accused,” he said.

Mr Tuah-Yeboah said investigations also revealed that Nyinaku between the year 2017 and 2018, caused the transfer of 35 fixed deposit investments of 23 customers of Beige Bank totalling GH¢141,042,348.92 to the Beige Group, a company wholly owned by him.

“Investigations further revealed that some time in March 2018, the accused person caused a fictitious second account to be opened in the name of First Africa Savings and Loans (FASL), an existing account holder with Beige Bank, without the knowledge of the board and management of FASL.

The accused person then caused the transfer of GH¢320 million from the accounts of various Beige Bank customers into the bank account of BCAM held with Beige Bank,” he added.

He noted that the GH¢320 million was, subsequently, transferred from the BCAM account held with Beige Bank into the fictitious FASL’s account that had been opened in Beige Bank’s books on the instructions of the accused.

Between March 2018 and August 2018, he said GH¢21.1 million out of the GH¢320 million was transferred from the fictitious FASL’s bank account to some two individuals and 10 companies, nine of which were related to the accused person, on the instructions of the accused person.

Again, between 2015 and 2017, he said Nyinaku through the use of payment vouchers, caused the sum of GH¢1.4 million of depositors’ funds lodged with Beige Bank to be paid to himself and other persons.

Investigations also revealed that the accused person, through the use of payment vouchers, emails and memos, caused a total amount of GH¢20.6 million of depositors’ funds lodged with Beige Bank to be transferred to a number of companies and individuals for his benefit.

These transactions, the deputy A-G said were recorded in a general ledger account of the bank described as ‘Shareholders Account’.

“Additionally, between 2016 and 2017, the accused person, through the use of payment vouchers, caused a total amount of GH¢141.7 million of depositors’ funds lodged with Beige Bank to be transferred to a number of companies and individuals for his benefit.

“Between 2017 and 2018, the accused person, through the use of payment vouchers, emails and memos, further caused the sum of GH¢118 million of depositors’ funds lodged with Beige Bank to be transferred to a number of companies and individuals for his benefit,” Mr Tuah-Yeboah said.

These transactions, he said, were also recorded in a general ledger account of the bank described as the “Beige Group Account”.

He told the court that investigations established that the money dishonestly appropriated by Michael Nyinaku from the defunct Beige Bank remained unpaid as of August 1, 2018, when the bank’s licence was revoked by the BoG.

SEND A STORY: Do you have a story for us or need a promotion / advertisement? Submit them via our email dannyboy744@gmail.com and via on +233 266777777