KPMG, AN accounting and auditing firm, has stated that government’s replacement of the TIN and SSNIT numbers with the Ghana National Identification Card could expand the number of registered tax payers to 15.5 million.

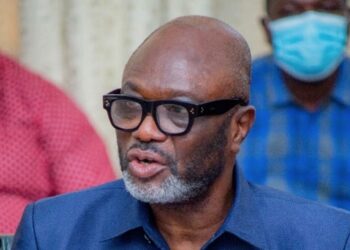

Anthony Sarpong, Senior Partner at KPMG, who made this known at a post budget virtual forum on Tuesday, said however more should be done to educate holders of the national ID cards on the new measure to achieve results.

According to him, tax reliefs introduced by government in the 2021 Budget, including the suspension of tax stamps for small businesses, would elicit additional cash flows.

He continued to urge government to consider providing capital support to help revive normal business for targeted sub sectors.

“Additionally, government should consider an extended loss carry forward period, in respect of COVID-19 specific losses, to support recovery in these subsectors — hospitality and education,” he noted.

The budget has introduced indirect tax measures and reliefs to manage the fiscal challenges experienced last year, including some reliefs to businesses gravely affected by Covid-19.

He advised government to adopt innovative ways to mobilise additional revenue, and continued its digitizing process and system efforts to ensure businesses thrived and survived in a competitive global environment.

He said the proposed interventions in the insurance sector could also boost the penetration of insurance services in Ghana; adding that while there had been significant improvements in access to insurance services in recent times, overall penetration of insurance services remained relatively low.

Government recently introduced some key priority areas in the 2021 budget. These included creating and sustaining jobs, delivering Covid-19 containment measures and vaccination, promoting entrepreneurship and wealth generation, implementing the Ghana CARES Programme, and creating fiscal space for their implementation.

Source: Dailyguidenetwork.com